Transition Finance Weekly - 9/26/2025

Arizona Commits to Clean Energy, PJM Grid In Trouble, Emissions Drop Nationwide

Exploring the policy, politics, and economics of the clean energy transition

Each week here in Transition Finance Weekly, researchers and analysts from Pleiades Strategy summarize the top stories and trends related to the policy, politics, and economics of the clean energy transition in the states.

WE WANT TO HEAR FROM YOU. What would you like to see in this newsletter? What kinds of developments would you like us to track? You can reach us at newsletter@pleiadesstrategy.com.

Subscribe to our Substack (it’s free!)

Welcome!

If you subscribed during New York Climate Week, thank you — we’re excited to have you here! Transition Finance Weekly will keep you in the loop on the energy transition.

Whether you stopped by our event, joined a panel, or connected with us in conversation, we’re thrilled to keep up the momentum with you.

1. Arizona Governor Issues Sweeping Clean Energy EO

Gov. Hobbs becomes the latest Governor aiming to ramp up renewables and protect clean jobs, affordability, and energy infrastructure.

In a forceful move to advance Arizona’s clean energy sector, Governor Katie Hobbs signed an executive order aimed at accelerating the development of renewable energy, storage, and transmission across the state. The EO comes in direct response to federal attacks on clean energy, which jeopardize 150,000 Arizona jobs and a $100 billion industry.

The order seeks to fast-track project approvals for solar, wind, geothermal, nuclear, and storage development on state lands. It also encourages EV adoption, boosts efficiency programs, expands tribal investments, and tackles long-term energy affordability.

To support large-scale grid modernization, Hobbs calls for a “generation and transmission corridor” plan that uses state lands to fast-track infrastructure, and for a framework for siting data centers that protects residents from higher costs. This signals Arizona is doubling down fast on clean energy in response to the federal pullback.

“Arizona is on the frontlines of the American power resurgence, creating the affordable energy future,” said Gov. Hobbs. “We have incredible potential to deliver affordable energy to every business and family who needs it. We just need to unleash it.”

2. Governors Convene in Philadelphia to Rescue Broken PJM Grid

All 13 states in PJM agree: The current system is broken. Can they fix it?

Governors, energy officials, regulators, and utility executives from all 13 PJM states gathered in Philadelphia this week for a long-overdue summit on the future of the Eastern Interconnection’s most embattled grid operator.

PJM, which oversees electricity markets for 65 million people, has come under heavy criticism for opaque planning processes, excessive delays in interconnection queues, and rules that disproportionately favor fossil fuels. There is broad consensus that the current system isn’t working, and governance reform was one topic on the agenda.

“Now hear me on this: exploring what comes next for PJM and the 13 states who have come here today doesn’t mean going backward to the same approaches we’ve used before,” said PA Gov. Josh Shapiro in his opening remarks. “It means looking forward and really grappling with how we can work together to meet our region’s energy needs while keeping costs down.”

3. Arizona AG Kris Mayes Pushes Back Against APS Rate Hike

This is the utility’s fourth rate increase request in just ten years.

Arizona Attorney General Kris Mayes is taking a firm stand against a proposed 14% rate hike from Arizona Public Service (APS), the state’s largest electric utility — its fourth proposed increase in a decade. In fact, she may demand a rate reduction.

Mayes is formally opposing both the rate hike and the utility’s proposed formula-based pricing mechanism, which would allow APS to automatically raise rates each year based on its return on equity.

As energy affordability becomes a political flashpoint in state after state, Mayes’ intervention shows that more public officials are willing to scrutinize utility economics and fight for consumers in an increasingly volatile market.

4. Maryland Rolls Out $200M Energy Rebate Program

Energy affordability is quickly becoming a volatile political issue, and Maryland is acting fast.

Governor Wes Moore, alongside House Speaker Adrienne Jones and Senate President Bill Ferguson, announced a $200 million energy rebate program this week, aimed at delivering immediate relief to Maryland households facing rising utility bills.

The program, funded through the Strategic Energy Investment Fund, will automatically provide two bill credits totaling around $80 per household. The move comes as demand for energy assistance in Maryland surges: over 156,000 residents applied for help last fiscal year.

Rebates like these don’t address the structural drivers of high energy costs, aging infrastructure, stalled clean energy deployment, and regulatory gridlock in PJM territory. Still, the program marks a growing recognition among policymakers that the energy affordability crisis is urgent.

5. Most Companies Are Already Experiencing Climate-Related Losses

They know what they need to do. Why aren’t they doing it?

A new survey from Marsh finds businesses underinvesting in climate adaptation even as the vast majority of companies surveyed say they’re already facing climate-related damages. This leaves critical infrastructure, supply chains, and investments increasingly exposed.

78% of responding companies say they’ve experienced direct impacts from climate-related events like flooding, extreme heat, or water stress, and 74% report actual financial losses or operational disruptions as a result. But only 38% have conducted a detailed climate-risk assessment and 22% don’t evaluate future climate risks at all.

Why don’t they act? 40% cite insufficient funding; other obstacles include competing business priorities, limited understanding of climate scenarios, and basic resource constraints.

“Organizations consistently underinvest relative to the severity of their identified risks,” said Amy Barnes, Marsh’s head of Climate and Sustainability Strategy. “Proactive resilience planning is essential to safeguard assets, maintain revenue streams, and protect long-term business viability.”

6. Sierra Club Releases New Climate Finance Principles

As Climate Week draws attention to global investment strategies, the Sierra Club has released a sweeping new framework to guide investors.

The Sierra Club’s new Climate Solutions Finance Principles aim to help financial institutions embrace real climate action rather than greenwashing, by outlining what credible climate-aligned investments should actually look like. Their goal is to inform public pensions’ and other major investors’ climate protection strategies at a moment when accountability is more urgent than ever.

At its core, the framework demands that capital flow toward projects and companies delivering measurable, real-world emissions reductions, not just improvements on paper. That means prioritizing renewables deployment and grid upgrades, community climate resilience, ecosystem protection, and credible science-based reductions. The framework looks less kindly on carbon offsets, unbundled RECs, and carbon capture and storage.

“Our guiding principles set a clear standard: credible climate investments must cut emissions, build resilient communities, and protect nature. Investors have a responsibility to put workers’ long-term security ahead of short-term profits,” said Jessye Waxman, Campaign Advisor in the Sierra Club’s Sustainable Finance campaign.

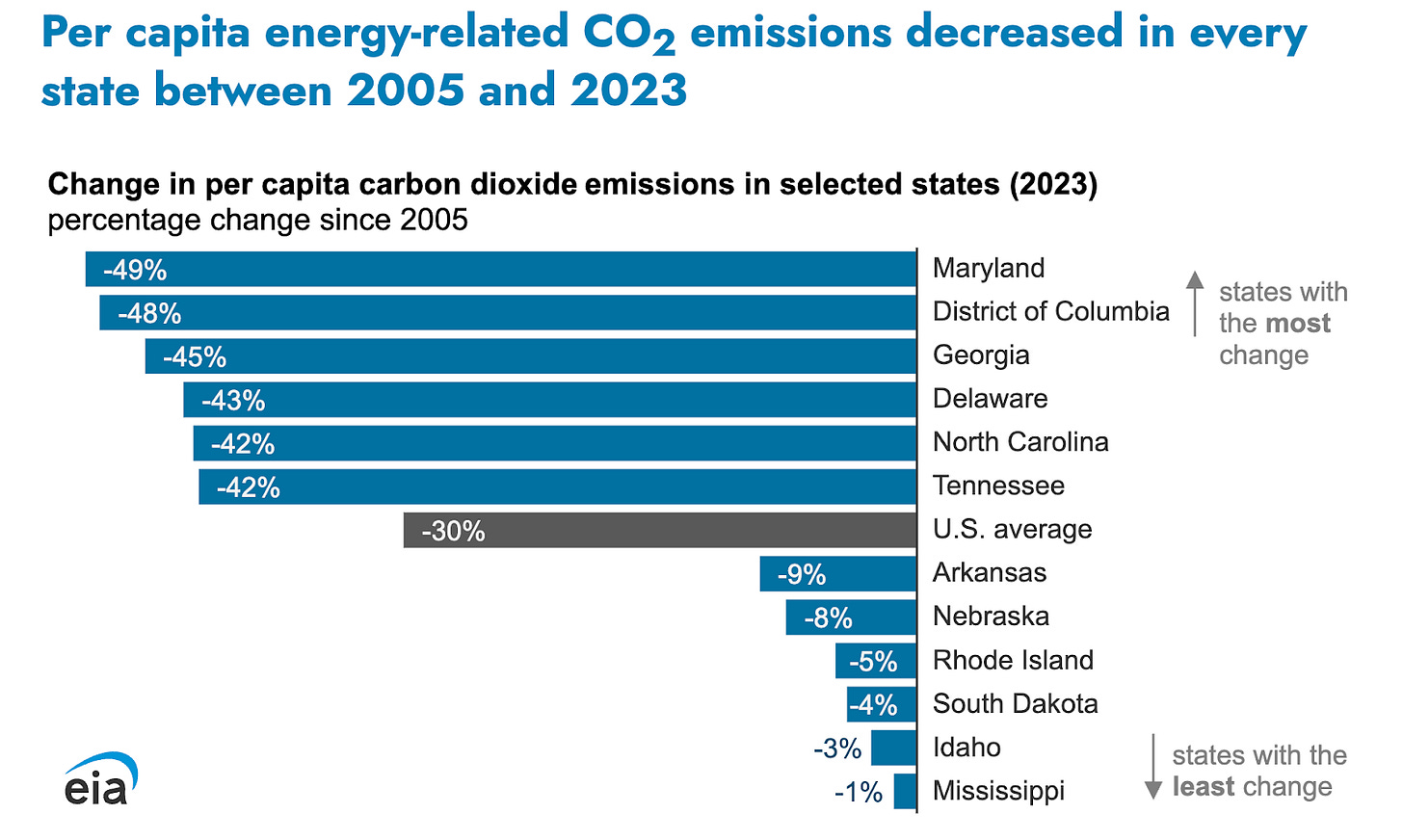

SPOTLIGHT: Per Capita CO2 Emissions Decreased in Every State Between 2005 and 2023 As the Economy Grew. How Cool!

From 2005 to 2023, U.S. per capita CO2 emissions from energy consumption decreased by 30%, driven by a 20% drop in total emissions despite a 14% population increase. This decline is largely due to reduced coal use in the electric power sector, replaced by natural gas, wind, and solar.

However, a slight 1% rise in total U.S. CO2 emissions is projected for 2025, partly due to increased fossil fuel consumption for crude oil production and growth in electricity generation.

In that same time frame, GDP has increased by 44% — decoupling emissions from GDP growth.