Transition Finance Weekly - 8/28/2025

Blue State SFOs Put Wall Street On Notice; Load Flexibility Expands; Renewables Lead Energy Growth

Exploring the policy, politics, and economics of the clean energy transition

Each week here in Transition Finance Weekly, researchers and analysts from Pleiades Strategy summarize the top stories and trends related to the policy, politics, and economics of the clean energy transition in the states.

WE WANT TO HEAR FROM YOU. What would you like to see in this newsletter? What kinds of developments would you like us to track? You can reach us at newsletter@pleiadesstrategy.com.

Subscribe to our Substack (it’s free!)

Breaking: BlackRock accuses “both parties of politicizing” pension funds after being targeted at least 29 times by anti-ESG politicians and receiving one letter from Democratic Treasurers.

1. State Financial Officers Call Out Wall Street’s Climate Backslide

A $3 trillion pension fund coalition demands asset managers “reaffirm their commitment to managing long-term risks.”

On August 15, 17 Democratic state financial officers, overseeing more than $3 trillion in public pension assets, sent a letter to BlackRock and 17 more of Wall Street’s biggest asset managers with a clear message: stop caving to right-wing pressure and start managing long-term risk like your job depends on it.

The letter was a counter to one sent by members of the State Financial Officers Foundation (SFOF), a dark-money megaphone for fossil fuel interests, which demanded firms abandon climate risk disclosures and climate-aware investing entirely.

From the Democratic letter: “Fiduciary duty, as properly understood, requires — not prohibits — investor consideration of material risks and long-horizon opportunities. Institutional investors, including public pension funds, are long-term owners. They bear the consequences of unmanaged risks —whether climate-related, governance-related, or supply chain-related — and must ensure that corporations and their boards address such risks with transparency and accountability.”

2. Federal Government Halts Nearly-Finished Wind Farm, States Move to Defend

The Trump Administration’s war on wind risks raising energy costs and threatening reliability.

An agency within Donald Trump’s Interior Department has served a surprise stop-work order on Skyborn Renewables’ 700 MW offshore wind project off the coast of Rhode Island, citing vague "national security concerns" — and putting in doubt the future of a wind facility that’s almost fully built and was set to power 350,000 New England homes with long-term, locked-in clean energy.

This is the second time this year a major offshore wind project has been paused or delayed, following April’s halt of Empire Wind off Long Island — and news broke this week that the Interior Department would be going after a third wind project in Maryland. The Empire Wind halt was temporary; New York Gov. Kathy Hochul got the project restarted, reportedly in exchange for reconsidering previously rejected gas pipelines. Rhode Island and Connecticut plan to take the federal government to court.

ISO New England, the grid operator for the Northeast, has warned that the pause on the project will “increase risk to reliability.” For energy customers in the Northeast, the project cancellation will just drive costs upward — and threaten energy supply on the heels of a summer dominated by record-breaking heatwaves and energy consumption.

The Global Wind Energy Council on the wind suspensions: “This is the kind of stuff that happens in third-world countries and instead it’s happening in what is supposed to be the bastion of the free market. It’s just not serious. It has an extremely chilling effect in the sense that the US is not a safe place for investment.”

3. Data Centers Acknowledge They Can Chip in to Help the Grid

The tech industry shows early signs of flexibility.

Duke Energy, a notorious overbuilder of gas, is urgently looking for options to reduce capacity strains after falling behind on renewables and demand from data centers soars. Enter: voluntary load flexibility programs in which large customers like data centers can scale down or temporarily suspend their power demand when the grid is strained, so peak loads can be served with less peaking capacity. This will help Duke reduce capacity overbuilding (and bypass the delays associated with construction) and handle demand spikes with the infrastructure it already has.

The Data Center Coalition, a trade group representing hyperscalers and colocation giants, has been opposed to load flexibility, but it has told regulators it’s changing its tune. True, it still opposes policies to make industrial power users pay for their portion of infrastructure costs. But its shift is notable, suggesting that the large power consumers it represents are willing to work with the rest of us to make sure the power system stays up and running.

Individual data center providers and customers are already experimenting to integrate flexibility into their operations. Google is applying demand-response to machine-learning workloads and Oracle is running a pilot to reduce peak demand in one of its datacenters.

4. Louisiana & Federal Government Team Up to Advance Fossil Exports, Block Renewables

The Department of Energy moves to drive up the price of fossil gas — while trying to force Americans onto it.

As the feds stall offshore wind, they’re quietly boosting natural gas. The Department of Energy just granted Lake Charles LNG, a terminal in Louisiana, an extension of time to start natural gas exports — which amounts to a handout to its owner, Energy Transfer LP.

The red carpet is being rolled out for gas as Gov. Jeff Landry and other Gulf Coast officials fight to hamstring renewable energy, to force utilities to consume more fossil fuels. This enriches their industry supporters, but makes no sense for anyone else: gas is economically volatile, seeing extreme price swings influenced by world events, and diverting more gas to the export market will make it even more expensive for domestic customers.

Americans have gotten used to paying much less for energy than people do in other countries, but thanks to moves like this, that may not be true much longer as US and global fossil gas prices converge.

5. Louisiana Regulators Approve Plan to Power U.S.’s Largest Data Center - Few Happy

The largest data center in U.S. history spurs approval of 2.25GW of new polluting gas and at least 1.5GW of solar.

The Louisiana Public Service Commission has approved Entergy’s plan to build three massive natural gas plants to power Meta’s $10 billion data center. The plants’ total capacity is 2.25 GW, but Meta’s projected demand for the data center could reach 5 GW all in. At least 1.5GW of solar is also planned to help meet the total power needs.

Some parties, including the Sierra Club and the Southern Renewable Energy Association, are satisfied with the deal, which would double the solar on Louisiana’s grid.

Balking at the deal? Ratepayer advocates note that the contract Meta has signed for the new plants’ output only covers the first 15 years of their likely 30+ year lifespan, and Louisiana ratepayers could then be stuck footing the bill for plants they didn’t want and power they don’t use, and other large industrial customers, including chemical and oil & gas giants, are also upset, anticipating that Meta will receive preferential treatment even though they’ve been waiting years for Entergy to fulfill commitments they had for renewable projects.

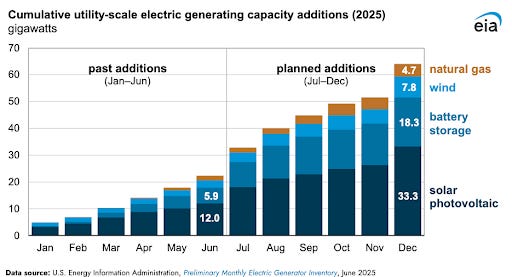

SPOTLIGHT: Renewables Are Winning, Despite… *Gestures Broadly At Everything*

Clean energy accounts for 93% of new U.S. capacity this year.

Federal regulators are doing their best to slow wind and solar, but the market has other plans. According to the U.S. Energy Information Administration, 93% of all new power generating capacity the U.S. will add in 2025 will be from solar, wind, or batteries.

Despite federal sabotage, resistance from right-wing extremists in the states, foot-dragging by inherently conservative utilities, and all the everyday complexity of permitting and construction, 12 GW of new utility-scale solar was added in the first half of 2025, and another 21 GW is expected by December. It’s just more evidence that it’s very hard for politics — even fanatical politics — to stop a market economy from making rational decisions.