Transition Finance Weekly - 4/17/2025

Tariff Impact, NYC Under Water, Clean Energy Beats Dirty

SPOTLIGHT: Catch our Insurance Panel Discussion at SF Climate Week!

Next Thursday, April 24, we will be hosting a panel discussion as part of SF Climate Week about how the insurance crisis is playing out in California. Join us for a solutions-based conversation with experts and advocates who are leading the way in building solutions to insure California’s future in a changing climate.

Panelists include:

Kate Gordon, CEO of CA FWD

Sierra Kos, Co-Founder and Co-Executive Director of Extreme Weather Survivors

Frances Sawyer, Founder of Pleiades Strategy

Grace Regullano, Eaton Fire Residents United coalition member

Moderator Megan Munce, San Francisco Chronicle climate reporter covering California's home insurance crisis.

You can register and find out more here—see you there!

1. Trump Appointed Judge Orders Biden Era Grants Restored Immediately

Clean energy projects to resume in win for rule of law.

On Wednesday, a federal judge ruled that the Trump Administration must release funds it attempted to impound funds appropriated under the 2021 Investment and Jobs Act and the 2022 Inflation Reduction Act, issuing a nationwide block on the Administration’s unlawful actions.

The order blocks agencies from freezing all funds awarded under the two Biden-era laws and instructs them to take “immediate steps” to release funds.

Not only is this a win for the climate, since funds for renewable energy projects, EVs, and updating infrastructure will go out, it’s a loss for the Administration’s sweeping efforts to bypass administrative and federal law. The Trump Administration, according to the courts, does not have unilateral authority to undermine Congress, ignore the law, and gut new energy projects that will generate cleaner, cheaper electricity for Americans.

Judge Mary S. McElroy of the U.S. District Court for the District of Rhode Island: “Agencies do not have unlimited authority to further a President’s agenda, nor do they have unfettered power to hamstring in perpetuity two statutes passed by Congress during the previous administration.”

2. “Liberating” America’s Energy Market … Not the Word We’d Choose

What do Trump’s Liberation Day tariffs mean for America’s energy transition?

The impact of new tariffs on America’s global position in solar and wind energy is nothing short of devastating. These tariffs give China another opportunity to take larger shares of emerging renewable energy markets and cut American renewable developers off from key suppliers.

Some costs are already clear: $10,000 more for electric vehicles, 10% higher costs for wind energy, and a 7% increase for renewable energy projects overall.

And the impact on fossil fuels is also notable:

Last week, oil fell below $60/barrel, below the benchmark most companies use when deciding to build new wells. Steeply falling oil prices mean oil producers think there will be less demand in the future, which is usually an indication of a contracting economy.

The capital expenditure math on utility-scale natural gas infrastructure is about to get worse. Natural gas turbines are already on backorder, driven by demand for data centers (whose components are also impacted by tariffs), and all the conditions slowing the supply chain just got worse.

Takeaway: Uncertainty is bad for the economy. It makes people cautious, and caution slows transitions. That means we’ll be set back in our efforts to advance clean energy — even though, in most situations, building more solar, wind, and battery storage is cheaper, faster, simpler, and safer than building more fossil fuel plants.

3. Big Banks Face Shareholder Climate Pressure

NYC Comptroller Brad Lander's still pushing for more climate disclosure.

NYC Comptroller (and mayoral candidate) Brad Lander, with the backing of city pension funds he oversees, has filed shareholder proposals at Bank of America, Goldman Sachs, and Morgan Stanley, calling for the companies to disclose their energy financing ratios and how much they’re investing in clean energy versus fossil fuels. That’s important information for investors trying to make rational choices.

Last year, Lander got JP Morgan Chase, Citigroup, and RBC to offer some concessions to disclose similar critical climate information. And despite the mass exodus of banks from the NZBA in January 2025, he remains steadfast in his goal: to align banks with the IPCC’s Net Zero by 2050 goal. His proposals cite research from BloombergNEF calling for a 4:1 clean-to-fossil investment ratio by 2030 and a 10:1 ratio in the following decades to reach net zero (spoiler: no major banks are on track).

Lander: “Climate risk is financial risk, and everyone can see it – in unprecedented wildfires, extreme flooding, and dangerously hot temperature. Others may walk back their climate commitments and cave to the current administration’s climate denialism, but we will not be cowed.”

4. Climate Change Is Coming for NYC Homes

If you thought the housing shortage was bad now…

A new report from the Regional Plan Association found that more than 80,000 homes in the New York City area are at risk of being lost to coastal flooding by 2040, with over half of them on Long Island and ocean towns like Babylon and Islip bearing the brunt.

This ominous climate warning comes as NYC grapples with a massive housing shortfall. The report points out that to meet demand, nearly 1.2 million new homes are needed over the next 15 years, and with climate change, the available land to build on will literally shrink.

Meanwhile, the city’s long-term coastal protection plan led by the U.S. Army Corps of Engineers is still 20-some-odd years away from completion and approval, leaving New York facing dual threats from climate change and a critical housing shortage without a plan.

This situation facing NYC drives home how serious and present climate change is for our cities as they figure out how to deal with crises present and future. Climate change is here, and it’s reshaping the housing markets not just where disasters have already hit, but everywhere. Even in Minnesota, generally considered to be a “climate haven,” home insurance rates are expected to rise 15% this year due to climate change-driven extreme weather events.

Amy Chester of the nonprofit Rebuild by Design: “The sooner we decide as a city to invest in resilience measures to help neighborhoods adapt — whether it’s to fortify or to move — the faster we avert leaving an even bigger crisis for the next generation.”

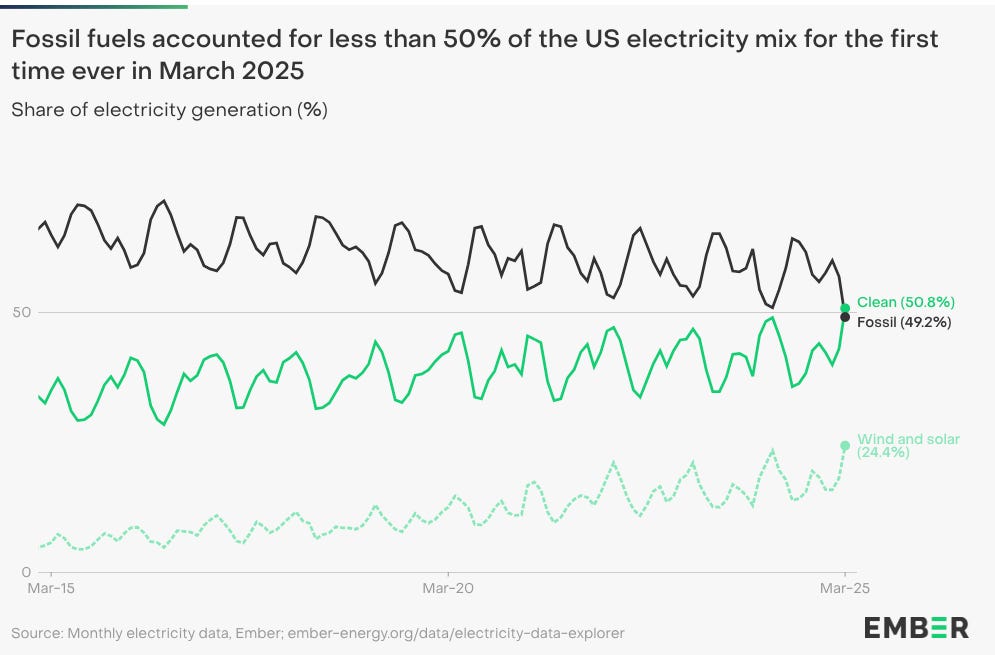

5. A Bright Spot: Clean Beats Dirty in New First

Clean energy provided more than half of U.S. electricity in March.

Clean energy provided more than half of U.S. electricity in March

In a historic milestone, clean energy generated more than half (50.8%) of U.S. electricity in March 2025, according to new data from Ember. Fossil fuels dropped to just 49.2%, their lowest monthly share on record.

The shift was largely driven by wind and solar, which together made up 24.4% of total generation, also a record high.

This is good news, and it reaffirms what we’ve been saying for a while: Clean energy is here to stay, and it’s reshaping the grid (despite some significant headwinds).