Transition Finance Weekly - 11/21/2025

Disclosure Hits Speed Bumps; Texas Messes With ERCOT Economics; Wisconsin Coal Terminal Announces Closure

Exploring the policy, politics, and economics of the clean energy transition

Each week here in Transition Finance Weekly, researchers and analysts from Pleiades Strategy summarize the top stories and trends related to the policy, politics, and economics of the clean energy transition in the states.

Subscribe to Transition Finance Weekly here. (Tell your friends!)

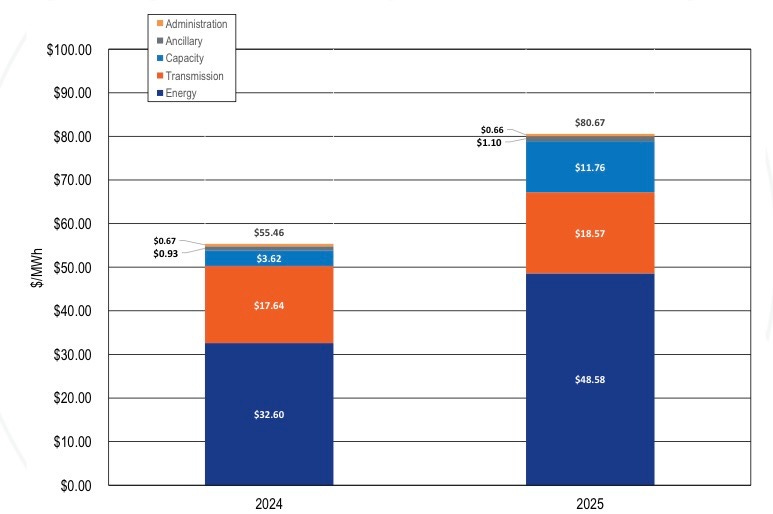

BREAKING: PJM’s wholesale power prices are up 45% from 2024, year-to-date, according to the Independent Market Monitor. The new data is yet another warning sign for incumbent policymakers as energy affordability becomes a more salient and pressing issue to voters.

Credit: PJM Independent Market Monitor

1. Industry’s Full-Court Press Against Climate Disclosure

Across Europe and the U.S., industry groups and their political allies are mounting an aggressive effort to weaken, or block, climate and sustainability disclosures.

Last week, the European Parliament, driven by the center-right EPP working in unusual coordination with far-right parties, voted to dramatically roll back core parts of the EU’s flagship disclosure laws, the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD), following intense lobbying pressure. The changes sharply restrict which companies must report their climate and human-rights risks. In the original CSRD proposal, more than 50,000 companies would have been covered. Under the new update, that number falls to just 10,000.

Exxon, who would be required to report their pollution and demonstrate a workable plan to reduce their pollution under these provisions, has referred to the CSDDD as a “bone-crushing burden.” Also weighing in on CSRD; conservative AGs across multiple states, who threatened companies, including Microsoft, Google, and Meta with potential legal actions if they comply with EU climate disclosure rules, and anti-ESG legislators who have proposed anti-ESG bills that specifically target CSRD and CSDDD.

Meanwhile in California, the U.S. Chamber of Commerce is escalating its fight against the state’s new climate disclosure laws, SB 253 and SB 261. After multiple injunction requests were denied by federal judges, the Chamber filed an emergency petition with the U.S. Supreme Court, asking the justices to block the laws while litigation proceeds. This week, the Ninth Circuit issued an order temporarily blocking the implementation of SB 261 pending appeal. Implementation of SB 253 is not subject to the pause and will carry forward.

Our take: In both California and the EU, the story is still being written. What has not changed with this news is that climate change is impacting companies’ bottom lines in material ways today — and that the energy transition is underway. Standardized, robust disclosure of emissions and risks help decision-makers navigate these realities and are critical way-marks on the path to a more sustainable future.

2. Texas Wants More Handouts to Gas

Texas regulators aim to pour billions into a capacity funding program that modeling says won’t solve reliability risks and that mirrors a plan regulators already rejected.

ERCOT has proposed creating what would essentially be a de-facto capacity market through its proposed DRRS+ program, an expansion of its existing Dispatchable Reliability Reserve Service (DRRS), which tries to guarantee 4 hours of dispatchable generation for tight system conditions. DRRS+ creates a system for paying generators simply for having “eligible capacity,” regardless of how much power they actually produce. The price tag: roughly $4 billion, almost all of which would flow to natural gas and other thermal generators.

The structure closely mirrors the Performance Credit Mechanism (PCM), a $1 billion capacity-style program the Public Utility Commission shelved in 2024 after concluding it wouldn’t meaningfully improve grid reliability. At the time, commissioners acknowledged PCM would cost ratepayers significantly while failing to solve the underlying risk of outages.

The only scenario in which outages fall to zero isn’t tied to more gas, it’s tied to flexible demand. According to Aurora’s modeling, if 60% of data centers operating in Texas become flexible (able to shift or shed load when needed), outages drop to zero even under high load growth.

“Texas should prioritize actions that increase reliability and reduce costs. If we exhaust actions that achieve both goals, then, and only then, should we look to artificially increase costs, as DRRS Plus would do. But we are nowhere near that point now,” said Texas energy analyst Doug Lewin.

3. Coal Can’t Even Compete on Reliability, Let Alone Cost

A new wave of analysis is dismantling the central claim behind the political push to revive coal: that it’s a “reliable” backbone for the grid. Not exactly.

Coal is now one of the least reliable energy sources. According to national outage data, coal plants experience mechanical or maintenance-related failures 12% of the time, nearly double the rate of wind (6.6%). Coal plants were designed for steady baseload operation. But as they’re forced to ramp up and down more often, wear and tear accelerates.

Coal’s reliability problem isn’t theoretical. Some of the biggest coal units in the country have suffered long-duration outages — including the Sandy Creek plant in Texas, the newest major coal plant in the U.S., which remains offline and may not return until early 2027.

Across the fleet, coal plants are offline roughly 15% of the time, planned or forced, compared with around 5% for gas plants. When those outages happen during periods of high demand, they trigger price spikes and grid emergencies, as seen during Winter Storm Uri. Coal isn’t the grid insurance its supporters claim it to be. It’s expensive, aging, and increasingly unreliable, precisely the opposite of what a modern, resilient electric system needs.

4. Wisconsin Coal Terminal Announces Coming Closure

The same month denizens across the Great Lakes commemorated the 50th anniversary of the tragic sinking of the Edmund Fitzgerald, DTE announced it would not renew its 50 year lease on a Wisconsin coal terminal and marked an inflection point in the Great Lakes industrial strategy.

After five decades of operation on the banks of Lake Superior, a major coal terminal in Superior, Wisconsin, will close next year, marking an ongoing economic shift in the region’s energy landscape. Midwest Energy Resources Company, a subsidiary of DTE Electric, announced it will not renew its long-running lease with Koch Industries when it expires on June 30. The decision effectively shutters the terminal and reflects a reality years in the making: demand for coal has collapsed.

Coal shipments through the Duluth-Superior port have fallen 75% from their peak, mirroring the national decline of coal in the power sector. The port’s operators cite the rapid rise of cheaper alternatives, including renewable energy and natural gas, as a core reason for the terminal’s downfall.

The terminal has been a rail-to-sea transfer point for coal coming from the Powder River Basin in Wyoming and Montana. This fuel fed power plants and industrial facilities across the Lower Great Lakes, part of a complex industrial ecosystem once deeply intertwined with the taconite from the Iron Range carried by the Edmund Fitzgerald and other ships to the steel mills in Cleveland, OH; Gary, IN; and other cities.

What is happening in the Great Lakes underscores the energy and accompanying industrial transition underway: the Duluth-Superior port welcomed a “big summer” for wind turbine blades, Duluth locals and experts across the midwest worked to expand and modernize the iron and steel industries, billions have flowed into new manufacturing facilities, and in 2024, the clean energy industry added nearly 1,700 jobs in Minnesota along.

Gordon Lightfoot, The Wreck of the Edmund Fitzgerald: “The legend lives on from the Chippewa on down // Of the big lake, they called Gitche Gumee // The lake, it is said, never gives up her dead //When the skies of November turn gloomy.”

5. Another Keystone Spill Underscores Pipeline Risks

Another reminder of the aging, failure-prone infrastructure underlying the U.S. oil transport system.

The Keystone Pipeline is again in the spotlight after a fatigue crack triggered a major oil spill in North Dakota earlier this year. South Bow, the pipeline’s operator, reported that about 3,500 barrels (roughly 147,000 gallons) of oil leaked onto farmland near the town of Fort Ransom. The source was a fatigue crack that formed along a manufactured long-seam weld, growing larger over time as pressure fluctuated within the line.

Cleanup and related expenses have reached $55 million so far. South Bow expects insurance to cover most of those costs, but as of September had recovered only $16 million. The pipeline restarted after a six-day shutdown, but the financial, environmental, and land-use impacts will linger far longer.

Keystone has a long history of leaks, several of them large, raising questions about the durability of aging long-seam pipelines and the adequacy of current safety standards. Each new spill reinforces the same lesson: even when operators follow existing rules, the risks inherent in transporting heavy crude across hundreds of miles of farmland and waterways remain significant.

SPOTLIGHT: Reports We’re Reading This Week

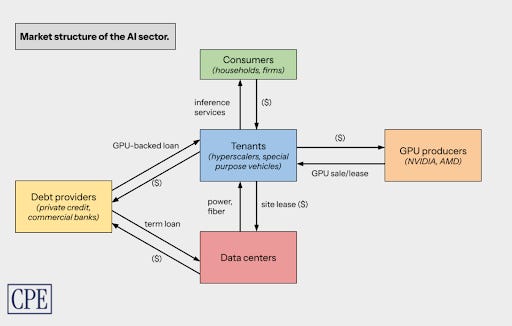

“Bubble or Nothing,” a new analysis from the Center for Public Enterprise (CPE) offers an analysis of the financial fragility beneath the AI and data center explosion. While headlines frame the buildout as an unstoppable economic engine, CPE argues the underlying economics are shaky, debt-heavy, and laden with systemic risks.

CPE concludes that the economic activity surrounding AI and data centers is precarious, driven by high-leverage bets on rapidly evolving hardware and uncertain long-term revenue streams. The report’s recommendation is blunt that policymakers should prepare now for the possibility of distress.

One standout takeaway: In contingency planning, policymakers should prepare to protect both ratepayers and power developers in case of a data center market correction and seek, where possible, to turn any downturn into a “productive bubble,” including through public investment in or even acquisition of stranded industrial assets. Policymakers can build plans to maintain and steward assets with strategic long-term value, in order to ease the blow to regional economies and direct valued infrastructure into continued useful life.